Before we dive into what Bitcoin is, let's first clarify what Bitcoin is not:

- Bitcoin is not a company.

- Bitcoin is not a stock.

- Bitcoin is not a currency for criminals only.

- Bitcoin is not a ponzi scheme.

- Bitcoin is not a scam.

- Bitcoin is not a bubble.

- Bitcoin is not a get-rich-quick scheme.

- Bitcoin is not used only for illegal activities.

- Bitcoin is not a tool for money laundering.

- Bitcoin is not a tool for tax evasion.

We could be talking about how Proof of Work works, what UTXOs are, what merkle trees are and all the technical caveats of Bitcoin, but that's not what this article is about. This is just a simple article to explain what Bitcoin is and which problems it solves. Thi is not about price predictions, technical analysis, or any other speculative aspect of Bitcoin, just the fundamentals for hodlers.

Bitcoin 101

In simple terms, Bitcoin is a decentralized digital currency that allows you to send and receive money over the internet. You might be thinking, "But I can already do that with my bank account or PayPal." And you're right, you can. But there are some key differences between Bitcoin and traditional payment systems that make Bitcoin unique.

1. Decentralization

Bitcoin is decentralized, which means that it is not controlled by any single entity, such as a government or a bank. Instead, Bitcoin is maintained by a network of computers around the world that work together to process transactions and secure the network. This decentralized nature of Bitcoin makes it resistant to censorship and government interference, and ensures that no single entity can control the network.

2. Limited Supply

Unlike traditional currencies, such as the US dollar or the euro, which can be printed by central banks at will, Bitcoin has a limited supply. There will only ever be 21 million bitcoins in existence, which makes Bitcoin a deflationary currency. The limited supply of Bitcoin is one of the key reasons why many people see it as a store of value, similar to gold.

3. Security

Bitcoin uses cryptographic techniques to secure transactions and control the creation of new bitcoins. This makes Bitcoin transactions secure and irreversible, which means that once a transaction is confirmed, it cannot be reversed. This security feature of Bitcoin makes it an attractive option for people who want to send money over the internet without having to rely on a trusted third party.

4. Transparency

All Bitcoin transactions are recorded on a public ledger called the blockchain. Even though many people think that Bitcoin is anonymous, it is actually pseudonymous, which means that all transactions are recorded on the blockchain and can be traced back to the sender and receiver. Therefore, it would not be a good idea to do illegal activities with Bitcoin, as it is not as private as many people think.

The FIAT money lie

FIAT money is a currency that a government has declared to be legal tender, but it is not backed by a physical commodity, such as gold or silver. You might be thinking, "But the US dollar is backed by the US government, so it must be valuable." And you're right, the US dollar is backed by the US government, but that does not mean that it has intrinsic value. And it also does not mean that its value cannot be inflated away by the government printing more money.

In fact, the US dollar has lost over 90% of its value since the creation of the Federal Reserve in 1913. This is due to inflation, which is the increase in the price of goods and services over time. In recent years, inflation has been blamed on various factors, such as the COVID-19 pandemic, supply chain disruptions, and wars. In reality, inflation is caused by the government printing more money, which devalues the currency and erodes the purchasing power of the people who hold it.

Inflation is a hidden tax that affects everyone, but it disproportionately affects the poor and the middle class, who have to spend a larger portion of their income on basic necessities, such as food, housing, and healthcare. In recent years, with record high inflation rates, many people have turned to investing into real estate, stocks, gold and other commodities as a hedge against inflation and as a store of value. This uncertainty in the traditional financial system has led to gold prices reaching record highs.

The digital gold

Gold shines as a secure and stable store of value and as a hedge against inflation. Yet, it has its limitations. Gold is heavy, difficult to transport, and expensive to store. It is also difficult to divide and difficult to verify its authenticity. Gold is also not easily divisible, which makes it difficult to use as a medium of exchange. Gold is also not easily transferable, which makes it difficult to use as a means of payment. Gold is also not easily verifiable, which makes it difficult to use as a unit of account.

This is where Bitcoin comes in, also often referred to as digital gold.

Bitcoin, like gold, is scarce and has a limited supply, which makes it a deflationary currency. Opposed to inflationary FIAT money, the supply of Bitcoin is capped at 21 million Bitcoin and cannot be inflated away by a central authority. So no matter what, the value of Bitcoin will always be preserved, as there will never be more than 21 million Bitcoin in existence. As long as people believe in the value of Bitcoin, it will always have value.

This is why many people see Bitcoin as a store of value, similar to gold. But it has many advantages over gold, such as being easily divisible, easily transferable, and easily verifiable. Imagine, you have a business in some third-world country with a hyper-inflationary currency. You would probably try to get all your money of the country as soon as possible, as the value of the currency is decreasing rapidly. With gold, you would have to carry around heavy gold bars, which are difficult to transport and difficult to verify. Even boarding a plane with gold bars would be a hassle, as you would have to declare them and pay taxes on them. With Bitcoin, you could just memorize your private key and travel to any country in the world without having to worry about carrying around heavy gold bars or declaring them at the border.

Wen moon? Wen lambo?

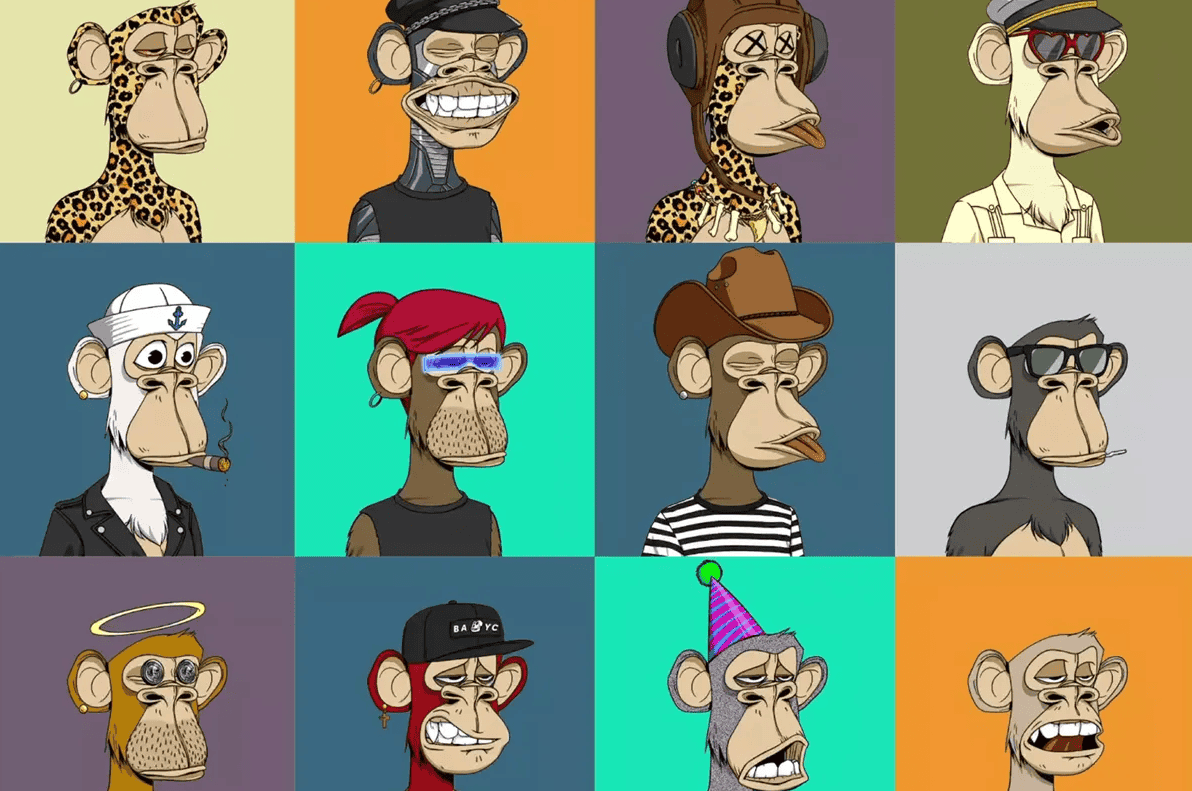

To be honest, what I hate about crypto is the constant price speculation and the moon talk. NFTs, Web3, DeFi, and other buzzwords are just distractions and actual straight up scams or hot air 99% of the time. There is so such a bad reputation around crypto in general, that it is hard to take it seriously.

But if you look past the hype and the scams, you will see that Bitcoin is actually a revolutionary technology that has the potential to change the world. Bitcoin is volatile, yes, but it is also a hedge against inflation and a store of value if you are in for the long run.

So, why does Bitcoin matter? Bitcoin matters because it is a decentralized digital currency that allows you to send and receive money over the internet without having to rely on a trusted third party. Bitcoin matters because it is a deflationary currency that is resistant to censorship and government interference. Bitcoin is a one of kind asset, unlike anything else in the world.

Conclusion

Bitcoin is not a scam, a bubble, or a get-rich-quick scheme. At its core, Bitcoin tries to solve one of the biggest problems of our time: the devaluation of FIAT money. We are super early and Bitcoin is slowly but surely gaining traction. Institutions are buying Bitcoin, countries are adopting Bitcoin, and people are starting to realize the true value of Bitcoin.

If you are still skeptical about Bitcoin, I would recommend you to do your own research and come to your own conclusions.

"Opinions are my own and not the views of my employer."